Now for the weekly review of our commodity futures positions - current as of January 11, 2009.

First, our top blog posts from the past week:

- Is It (Finally) Time to Short US Treasuries - And Make a Fortune?

- China Starting to Regurgitate US Debt

- Marc Faber on Bloomberg: World War III Has Already Begun

A review of our trades and positions from the previous week:

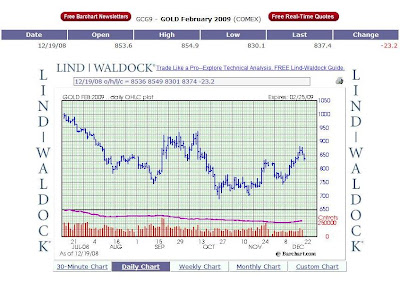

- Sold our mini-gold futures contract - to make way for another grains contract. This was a position sizing move - gold had not yet hit our sell stop.

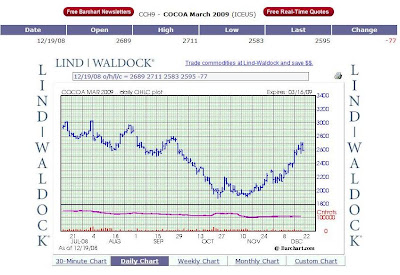

- Also sold our one cocoa futures contract - also for position sizing purposes. Cocoa was not performing as well as wheat, so we decided to add to our wheat position.

- Bought one more wheat futures contract - wheat put in a strong performance this week, up $0.20.

- Continued to hold one corn futures contract. This was an attempt to "pyramid" our grains position and diversify. Corn was up $0.02 on the week.

- Continued to hold one cotton futures contract - we LOVE cotton at these prices - as we've discussed with before in this space. Cotton was up slightly on the week.

- And finally, the dunce cap so far goes on our decision to eat our own dog food and short the 10-Year Treasury Note. We haven't lost hope yet, but will have to exit this position if new highs are hit. It won't be the first time we've gotten burned on this trade.

Commodities that appear quite beaten down - but we don't own them...yet...

- Sugar

- Coffee

- Natural Gas

- Silver

- Crude Oil

Open positions

| Date | Position | Qty | Month/Yr | Contract | Entry Price | Last Price | Profit/Loss |

|---|---|---|---|---|---|---|---|

| 12/29/08 | Long | 1 | MAR 09 | Corn | 422 1/4 | 412 | ($512.50) |

| 12/31/08 | Long | 1 | MAR 09 | Cotton | 48.52 | 49.33 | $405.00 |

| 01/06/09 | Short | 1 | MAR 09 | T-Note (10yr) | 123-285 | 125-220 | ($1,796.88) |

| 12/24/08 | Long | 1 | MAR 09 | Wheat | 579 1/4 | 630 | $2,537.50 |

| 01/06/09 | Long | 1 | MAR 09 | Wheat | 627 3/4 | 630 | $112.50 |

| Net Profit/Loss On Open Positions | $745.63 | ||||||

Account Balances

| Current Cash Balance | $47,783.90 |

| Open Trade Equity | $745.63 |

| Total Equity | $48,529.53 |

| Long Option Value | $0.00 |

| Short Option Value | $0.00 |

| Net Liquidating Value | $48,529.53 |

Cashed out: $20,000.00

Total value: $68,529.53

Weekly return: -2.1%

2009 YTD return: -4.5%

2008 return: -8%

***"Cash out" mostly means taxes - lately we've also been using it for living expenses, and also to finance our time management software company that was recently covered by the Sacramento Business Journal and Inc magazine.

Jerry_Rice_Photo.jpg)