- Greece should be allowed to go bankrupt (good ol' free market guy)

- Thinks government spending is the big risk factor in the global equation

- Says we should keep an eye on Iceland's big volcano

- Prefers silver to gold at these prices

Thursday, April 29, 2010

Jim Rogers Shares His Latest Outlook on CNBC Squawk Box

Investing in Gold Stocks: So When Are We Gonna Get Rich Already?

Casey Research's Jeff Clark takes a look at the historical performance of gold during previous bull markets, as he pieces together a guess about when he believes gold will take off...

By Jeff Clark, Senior Editor, Casey’s Gold & Resource Report

Here at Casey Research, we eagerly awaited the release of quarterly reports from the companies in our favorite sector. Why? The gold price was substantially higher last quarter than during the comparable meltdown quarter of 2008, so we were anxious to find out if it would lead to a spike in profits.

Gold and silver producers posted substantially higher net profits, and yes, much of it due to higher metals prices. But amazing to many, higher profits did not lead to higher – or at least not significantly higher – stock prices.

While most saw their stocks rise the day of their respective announcements, some actually fell if gold or the broader markets were down on the day. And they certainly didn’t jump like you might expect when “soaring profits” splashed the headlines of their press releases.

What gives?

We have some answers straight ahead, including a big fat clue as to when gold stocks will take off and give us those “magical” price levels we think are coming.

Gold Stocks Are Still Going to Take Off, Right?

We think that at some point the public is destined to participate in precious metals stocks, and when they do, we’ll see volumes jump and share prices take off.

But for now, gold stocks are playing follow the leader…

… rising and declining in tandem with the S&P since last April. So, until gold stocks separate from the overall market, we should anticipate they’ll tag along if the markets slide. And we think the path of least resistance for the stock market is down, not up, so caution is warranted about going overweight our stocks.

But just as we showed with gold last month, gold stocks will similarly propel higher when the general public crowds in, regardless of what the markets are doing. Here’s what gold stocks did in the last great bull market, compared to the S&P.

As measured by the Barron’s Gold Mining Index (a good substitute for the HUI that didn’t exist), gold stocks rose 652% during the 1970s (through January 1980), while the S&P returned a wimpy 22%. The action in the ‘70s was definitely in gold and gold stocks, despite two recessions that decade, and we think a repeat is in the cards.

When the masses finally wake up, it’s highly probable our returns will match the chart above or the late ‘90s surge in Internet stocks.

Is Now a Good Time to Buy?

As investors, our goal is to get positioned in the best stocks at the best price. And buying low assures us of more profit when we eventually sell. So, are gold stocks “low” right now?

We have a couple clues to help answer that, with gold itself offering the most important hint. Let’s compare how gold stocks are performing in relation to gold to see if they’re overvalued or undervalued or somewhere in between.

The chart shows that gold stocks, as measured by the HUI Gold Bugs Index, outperformed gold until 2008. Since then, gold stocks have underperformed gold by a fairly wide margin.

This gold-stock-to-gold ratio tells us that in our bull market, gold stocks are currently undervalued relative to the gold price. This doesn’t mean they can’t get cheaper, of course, but it does signal they represent good value and that compared to their underlying asset, there’s lots of room to the upside.

So, if you have a long-term perspective and the patience to wait until gold stocks begin outperforming gold again, today’s prices are good prices.

So, do we buy? The answer depends on your current exposure to gold stocks, how much gold and cash you have, and your outlook. If you own equities exceeding one-third of your total investable assets, we wouldn’t rush to buy. If you have limited (or no) exposure and a patient mindset to see you through until the big payday, even enduring temporarily lower prices along the way, then buying some now is probably a good move. If you have very little in the way of savings and gold, we’d put money there first before committing a big chunk to gold stocks.

Basically, the larger your stable of gold stocks, the more stubborn you should be about price. And we wouldn’t go “all in” just yet. Your risk in loading up now is if markets were to take another nosedive. But if you’re light on stocks, adding some of the best of the best at this time should work out well, as long as you don’t panic into selling on general market weakness.

Just Tell Me When!

The #1 indicator that will tell us when gold stocks will take off has nothing to do with charts and is something you can monitor yourself: it will be when your neighbors and co-workers begin to express curiosity. You obviously want to be invested before them, but that’s when things will start to get exciting.

So when might “gold fever” strike your neighbor? History holds the best clue:

►In the 1970’s bull market, gold stocks began their big ascent when the gold price hit about $450/ounce. Adjusted for inflation, that would equal roughly $1,340 today. So, when we see gold rise decisively above $1,300 and stay there, that just might be the trigger that spurs the interest of the masses in gold stocks. That’s not a prediction, but it does give us an idea of what to look for.

Casey Research chief economist Bud Conrad was right when he called for gold breaking through the $1,150 barrier in 2009 – and now he’s calling for gold to break over $1,450 by year’s end. Weighing in as well, Doug Casey himself sees precious metals as the only asset class worth buying now, and gold stocks as being the best way to add speculative leverage to those investments.

Exciting? You bet. We’re convinced that, sooner or later, higher prices are ahead for the best gold- and silver-producing companies, along with the “magical” levels that can happen in a mania. So, while we encourage caution, we also encourage selective participation so you don’t get left behind. Waiting for the “perfect” time to buy is an exercise in self-deception; nobody can time the market.

Let’s be honest: no one can guarantee when or if a gold mania will happen. But all of our research points to higher prices for gold (and silver), so we remain confident we’re in the right sector. And we can make money before the mania gets here.

To learn where to buy physical gold and where to store it… and which major gold stocks, mutual funds, and ETFs are the safest while giving you handsome upside… read Casey’s Gold & Resource Report. At $39 per year, it’s a steal for the value you get out of it. Click here for more.

An Everyday Commodity With Record Bearish Sentiment Against It Right Now

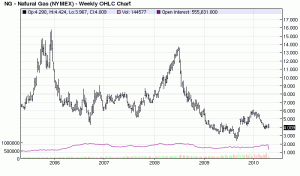

Specifically, right now, there are more bets against natural gas by large speculators than there have ever been in history.It sure has been a tough past few years for The Natty - hovering around 5-year lows!

The old rule about the large speculators goes something like this... They're "wrong at extremes, and right in between." Right now, we're at the greatest extreme, ever. Chances are, they're wrong.

The thing is, all these bets against natural gas have to be reversed... That means we must see billions of dollars worth of "buy" orders in natural gas futures, because that's the way these traders close out their trades. So the price of natural gas could rise dramatically – and possibly soar – just in the normal course of all these large speculators entering billions of dollars worth of "buy" orders to close out their bets against natural gas.

I love it.

Now think about this... Natural gas has a permanent price "floor." When it gets particularly cheap, energy companies want to substitute natural gas for what they're using – whether it's oil of some kind, or coal, or whatever.

Why is natural gas so hated? In short, there's too damn much of it available right now. Commodity prices are amazingly efficient at correcting supply/demand imbalances.

When Natural Gas spiked in 2006, and North America was reportedly running out of it, producers went to work, and figured out how to extract it from new places, like shale. Supply went way up, and prices collapsed - not bad for a "free" market!

If you're thinking about a speculative position here, the natural gas ETF ticker is UNG.

And if you're looking for a great supply/demand breakdown, here's a great piece of natural gas fundamental analysis by Casey Research's David Galland.

Wednesday, April 28, 2010

Two Trading Ideas: Go Long Volatility and Short China

- With the VIX near 18-month lows, here's a way you can profit from rising volatility

- And Chinese stocks are (still) not looking good - it may be time to punt on a China short

Tuesday, April 27, 2010

Where to Invest During Deflation - Maybe in Gold After All?

Read the rest of this post about whether or not to invest in gold during deflation here.

Our Brand New Blog - ContraryInvesting.com!

- ContraryInvesting.com will be the place to catch all the latest financial news, with our usual sarcasm sprinkled in.

- It will also have a free daily newsletter component - one concise email with highlights from the day, and links to the articles - if you'd like to receive that, you can sign up here.

- Commodity Bull Market will stay for now, and will return to it's original purpose - to track commodity news.

Thursday, April 22, 2010

Are Stocks Overbought Right Now? Expert Market Technician Weighs In

David Rosenberg: The Bubble in Finance is (Almost) Back!

“The financial share of total profits bottomed at 10.8% in the fourth quarter of 2008,” Rosenberg continues, “and has since soared to 28.2% of total profits, one of the highest percentages ever. This trend does not look sustainable to me.”

Wednesday, April 21, 2010

An Exclusive Socionomic History of Goldman Sachs - Part 2

Get tomorrow's financial news today! To understand what that means, you must think and act independently from the crowd. Learn how by downloading Elliott Wave International's FREE 118-page Independent Investor eBook here.

Get tomorrow's financial news today! To understand what that means, you must think and act independently from the crowd. Learn how by downloading Elliott Wave International's FREE 118-page Independent Investor eBook here.

Goldman F@#king Sachs - A Hilarious Daily Show Clip

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| These F@#king Guys - Goldman Sachs | ||||

| www.thedailyshow.com | ||||

| ||||

Tuesday, April 20, 2010

A Brief, Unapologetic History of Goldman Sachs - Part 1

The firm's history suggests its vulnerability in periods of negative social mood.

By Vadim Pokhlebkin

April 16, (Reuters) - Goldman Sachs Group Inc was charged with fraud on Friday by the U.S. Securities and Exchange Commission in the structuring and marketing of a debt product tied to subprime mortgages.

Shocked? Most of the subscribers to Elliott Wave International's monthly Elliott Wave Financial Forecast probably weren't. In the November 2009 issue, the EWFF co-editors Steven Hochberg and Peter Kendall published a careful study of Goldman Sachs' history -- and made a grim forecast for the firm's future.

In this special three-part series, we will release the entire Special Report to you. Here is Part I; come back tomorrow for Part II.

Special Section: A Flickering Financial Star

At the Dow’s all-time peak in October 2007, Goldman Sachs Group Inc., was the undisputed heavyweight champion of the financial markets. And, thanks to its bailout by Warren Buffett and the U.S. Treasury as well as the liquidation of rivals Bear Stearns and Lehman Brothers, its reign lives on. Come December, earnings and bonuses will reputedly approach the record levels of 2007. If the market can hold up, it might happen. But as the stock market retreat grabs hold, Goldman Sachs will experience an epic fall.

To understand the basis for this forecast, we need to review the firm’s history in light of socionomics.

At the beginning of the last century, Goldman Sachs originally made a name for itself with its first initial public offerings, United Cigar and Sears Roebuck. The deals came as the stock market made a multi-year top in 1906. Within months, the panic of 1907 was on, and a U.S. Interstate Commerce Commission investigation of the Alton Railroad Company bond offering, in which Goldman participated, was in full swing. According to The Partnership, Charles Ellis’ history of Goldman Sachs, the deal was “long remembered as ‘that unfortunate Alton deal’.” The bond issue allowed a considerable cash surplus to be paid out to shareholders in the form of a one-time dividend, a standard financial maneuver in the preceding bull market. In fact, the deal was unknown to the public until it came before the ICC in 1907. “Then, probably to the surprise of the syndicate, the verdict was practically unanimous against them. They were tried before the bar of public opinion and found guilty,” said author William H. Lough in Corporation Finance. Lough added that syndicate members “ought not be too severely criticized for they merely acted in accordance with the custom of the period.”

So it goes when social mood, and concurrently the market’s trend, changes; customary Wall Street devices are invariably recast as the instruments of evil financiers.

Another bear market problem is that Wall Street firms are just as susceptible to negative mood forces that tear away at even the most close-knit social units. From 1914-1917, a major rift emerged between the founding Goldman and Sachs families, and the Goldman side of the partnership left the firm. The tension endured through several generations, and as late as 1967 it was said that “hardly any Goldmans are on speaking terms with any Sachses.”

Larger degree social-mood reversals create larger bear-market complications. The firm’s biggest and most devastating setback came after the Supercycle degree top of 1929.

The firm was not yet a major force on Wall Street, but by hiring MBAs from top schools, fostering a reputation for fair dealing and maintaining a partnership structure that aligned the ownership of its principals with the long-term success of the firm, Weinberg laid the foundation for rapid growth. In the words of Gus Levy, Weinberg’s successor, Goldman Sachs was “long-term greedy.” Another Levy secret was to be certain that positions exposing capital were “half-sold” before they were entered into.

Come back tomorrow for Part II of this three-part Special Report from Elliott Wave International (EWI). In the meantime, get more free and insightful analysis from EWI in the Market Myths Exposed eBook. The 33-page eBook takes the 10 most dangerous investment myths head on and exposes the truth about each in a way every investor can understand. You will uncover important myths about diversifying your portfolio, the safety of your bank deposits, earnings reports, investment bubbles, inflation and deflation, small stocks, speculation, and more! Learn more about the free eBook here.

PLUS -- don't miss Bob Prechter's just-published forecast for 2010-2016 in the new, April Elliott Wave Theorist. Get it here.

Vadim Pokhlebkin joined Robert Prechter's Elliott Wave International in 1998. A Moscow, Russia, native, Vadim has a Bachelor's in Business from Bryan College, where he got his first introduction to the ideas of free market and investors' irrational collective behavior. Vadim's articles focus on the application of the Wave Principle in real-time market trading, as well as on dispersing investment myths through understanding of what really drives people's collective investment decisions.

Monday, April 19, 2010

How to Differentiate an Inflation Induced Rally From a Normal Run-of-the-Mill Retracement

Uh oh!

In his latest assessment of the economy, Mr. Bernanke told a congressional committee the pace of the recovery this year will depend on if consumers spend and companies invest enough to make up for fading government support.

"On balance, the incoming data suggest that growth in private final demand will be sufficient to promote a moderate economic recovery in coming quarters," the Fed chief said to the Joint Economic Committee.

- Still likes commodities for another 5-10 years (based on the secular bull market beginning in 1999)

- Thinks gold will top $2,000 by the end of the decade, thanks to money printing

Friday, April 16, 2010

How to Invest Wisely Based on Tax Laws - A Primer

The Tax Window of Opportunity

By Vedran Vuk, Casey Research

The biggest danger to your wealth isn’t a bubble in China or Europe – it’s the IRS. Since 1987, top earners have been taxed between 28 percent and 39.6 percent, a relatively low range compared to the 50-percent-and-above rates for most of the century. However, with enormous annual deficits and Social Security lurking around the corner like a mugger, the future promises a return to old tax norms.

Historical income tax rates reveal grim days ahead for U.S. taxpayers. The federal income tax began innocently enough, in 1913, by imposing a 7 percent levy on the top bracket. But immediately with the start of WWI, rates exploded to 77 percent and continued at 73 percent even three years after the conflict. Then, taxes began slowly easing from 56 percent in 1922 to 24 percent just before the 1929 market crash.

The lower rates didn’t last long, though. By 1932, three years into the Great Depression, rates rose to 63 percent, peaking at 94 percent in 1945. Even now, more than 80 years later, the income tax has never returned to the 1929 level.

Capital gains taxes aren’t historically immune either. During the 1970s, the maximum rate on long-term gains reached almost 40 percent, according to the Tax Foundation. For the past 50 years, rates have hovered between 20 and 30 percent.

In the early years of the Great Depression, the U.S. government spent extravagantly without anyone paying the bill – just like today. Naturally, this situation could not last forever then, and it will not last forever now. Someone will have to pay the piper, and it won’t be the bottom 50 percent of the population.

With the Bush tax cuts expiring this year, income taxes will rise from 35 to 39.6 percent for the top bracket. Though less likely, the expiration also threatens to raise capital gains taxes to 20 percent, with increased dividend taxes following suit. Next there are the new health care bill taxes, which will require an additional 16,000 IRS agents to enforce. Further, cap-and-trade won’t make life any easier.

On the horizon, the outlook is even darker with the proposition of value-added taxes (VAT). VAT works like a backdoor sales tax. Essentially, every time a producer of goods purchases raw materials, he must pay a percentage tax. When the producer sells his goods to a wholesaler, the wholesaler pays another percentage.

It sounds bad already, but here’s the worst part. Each company down the supply chain gets a tax discount based on the next company’s tax payment. Through this method, every firm in the chain has an incentive to make sure that the next one pays the full amount. If they don’t, then your company is left holding the bag.

In other words, the VAT makes every businessman an agent of the IRS. In the end, the higher cost of goods is passed down to consumers. However, unlike sales taxes, consumers will never see the bill directly on their receipts. This makes VAT far more politically efficient and insidious.

At this point, high taxes are the only way out of the long-term debt crisis – unless the Federal Reserve wants to see double-digit inflation. Mild Clinton-era taxes expected by most won’t solve the problem. A 4 percent income tax hike is not going to repay trillions of dollars in debt. Betting on the bull market isn’t a good plan either. America would need decades of unprecedented growth to escape unharmed. The U.S. needs more than a bull market – it needs a miracle.

If taxes are hiked to the stratosphere, a market recovery will do little for the wealthy. The fruits of a bull market will be difficult to enjoy with exorbitant taxes. For what does it profit a man to gain the whole world and be taxed on 80 percent of it? Even if market conditions become more favorable, the tax environment will drastically change soon.

In a sense, there is more opportunity in the middle of a low-tax recession than in a boom with cutthroat rates. Waiting for a stock market recovery is a losing decision tax-wise. The best way to grow your wealth is to earn it sooner rather than later.

Now is the moment to utilize excess funds wisely and invest to fill the gap for future shortfalls. While taxes are still low, a window of opportunity is open. There’s no better time to find top-notch investments and make a profit while the going is good.

There’s no doubt taxes are rising – whether it’s through straightforward increases or stealthily through a VAT. The Casey Report keeps investors up to date on the big economic and market trends, so you can keep more of your hard-earned money. Try it now risk-free – with our deeply discounted Tax Day Deduction Deal and 3 full months to decide if it’s for you. Plus, as a bonus gift, get two of our most popular precious metals and energy advisories… FREE for 1 year! Click here to learn more.

Why You Should Short America Right Now - A Classic Contrarian Signal

Uh oh!

What, If Anything, May Hold Up If (When?) Stocks Tank Again

Thursday, April 15, 2010

How to Out-Trade the Mighty Goldman Sachs

"Invest in the BRIC's...S&P rally to continue for now...yawn"

How to Short Sell Stocks - The Basics You Should Know

Sell Now, Buy Later – the ABCs of Short Selling

By Jake Weber, Editor, The Casey Report

The catch phrases “Buy low, sell high” and “The market fluctuates” are probably the two most frequently used clichés of the investment world. The latter statement is hardly astute, and the former far easier said than done. What both of these simplistic ideas overlook is a third concept largely ignored by the investing public, “Sell now, buy later.”

The idea of selling something that you don’t yet own is a foreign concept to many. However, in a powerful bear market, it’s an important strategy to understand and utilize, though for reasons I’ll discuss below, only as a relatively small and closely watched speculative portion of your portfolio. The concept I’m referring to, of course, is short selling.

The basic mechanics of selling short a stock are not complicated, but, as with any investment, there are risks involved, and it requires discipline to execute these trades successfully.

What Is Short Selling?

If, after carefully scrutinizing a security, you conclude that there is nowhere for the stock to go but down and want to put your money where your brain is, there are a couple of different alternatives. One way to go is the options route, selling calls or buying puts on the stock. This is certainly a viable route with plenty of opportunity to profit; however, with options, not only do you have to be right about the direction, you also have to be correct about the timing and strike price.

The other alternative is to open up a margin account and sell the stock short. That requires posting a margin – cash or securities – in your account. With that condition met, your broker will undertake to borrow the stock from someone that owns it. Once your broker has acquired it, either from another client or another brokerage firm, he or she will sell the stock and deposit the proceeds into your account. What you own now is a liability to purchase back, or “cover,” those same shares at some point in the future, hopefully at a lower price. Because there’s a loan involved with this transaction, you’ll be charged an interest rate on the amount borrowed, likely in the area of about 4.5% annualized these days.

With a short sale, your maximum gain is capped at 100%, which you would only collect if the stock goes to zero – but your loss is technically unlimited because stocks have no cap on the upside. Of course, there are ways to limit your losses, which we’ll discuss in a moment, but first let’s look at what could happen to your account should the stock fall, as you hope it will… or rise, as you hope it won’t.

For the purpose of this example, let’s say you came to the conclusion that XYZ stock is overvalued at $25 a share and so you sell short 100 shares. Here are the implications of two different scenarios subsequently unfolding:

Your maximum profit of the XYZ short sale is $2,500, but the sky is the limit for your losses and will be magnified, should you use margin. This potential for open-ended loss is enough to deter most investors from shorting, and is the reason we recommend you do so only with the speculative corner of your portfolio.

Minimizing Risk

Short selling is an aggressive strategy to pursue. There are, however, measures you can take to help mitigate risk.

Limit Your Margin

One of the ways to avoid large losses is by limiting the amount of margin used to borrow the shares. To sell short in the U.S., regulations require that the stock be “marginable,” and an initial deposit is required – 50% for stocks above $5 per share and 100% margin for stocks below $5 per share. After you borrow the shares, the rules require you maintain equity in the account worth at least 25% of the total market value of the security.

These are the regulatory minimums; individual brokerages may have additional rules and limitations for margin accounts, so be sure to carefully review your margin agreement. Even so, to avoid being “chased out” of a trade, you may want to deposit more cash than required by your broker in order to further cushion your position.

Keep in mind that the interest paid on the borrowed money will eat into your returns, reducing your potential upside, the longer you hold open a position. Also, any dividends issued while you are borrowing the stocks will be transferred from your account to the original buyer. We highly recommend that you actively monitor your account to avoid any margin calls and minimize your risk by reducing the use of margin.

Use Stop-Loss Orders

If you aren’t able to actively manage your investment accounts, then stop-loss orders can help soften the blow if the trade quickly turns against you. When the general market or sector gains upward momentum, even the fundamentally weakest stocks can catch a free ride. In order to limit your loss, consider placing orders to “buy to cover” at a price above your initial short sale price and remember to review your stop-loss orders periodically to assure you are covered.

A Few Key Terms:

· Short Interest: This is the aggregate number of short sale positions on each security. This information is published monthly by the exchanges and also offered through many other websites such as Barron’s and Yahoo Finance. It’s important to monitor how many shares have been borrowed because they will eventually have to be bought back (see Short Squeeze, below). Generally, the lower the short interest, the better.

· Days to Cover: This is another important data point to track, because it’s an estimate for how many days it will take to unwind all the outstanding short positions. It’s calculated by dividing the current short interest by the average daily trading volume of the stock. The fewer days to cover, the better.

· Short Squeeze: Should a stock appreciate by a substantial amount, it is entirely to be expected that some number of short-sellers will decide to cover their short or be forced to it by margin calls. Of course, that requires closing their positions by buying the stock back, which gives the stock further upward momentum. This may in turn force other short-sellers to cover, thus creating a rush to cover known as a short squeeze. Using stop-loss orders will help prevent getting caught on the wrong end of a short squeeze.

· Called Away: This refers to being forced to cover your short position because the lender requires delivery of the stocks. While this technically could happen at any time, it is exceedingly rare and would typically occur only if a clearing house couldn’t find shares to borrow for exchange-traded funds. This is something certainly to be aware of, but it’s not a cause for great concern, in our opinion.

Proceed with Caution…

If short selling fits within your scope of risk tolerance, it can be very profitable. Even so, it’s important you avoid being overleveraged in any position and never, ever “bet the farm” with a short position. Rather, only invest with money that you can afford to lose and consider using stop-losses.

As Jake says, short-selling can be very lucrative – if you correctly assess the broad market trends. That’s what The Casey Report does: analyzing budding trends and finding the best opportunities to profit from them. And as a special Tax Day offer – for 2 days only – you can now get The Casey Report for $150 less… PLUS one free year of our two most popular precious metals and energy advisories. Click here to learn more.

Most Popular Articles This Month

-

On Saturday, agricultural ministers from the world's (roughly) eight most industrialized nations, met in Italy to discuss the looming th...

-

This Thursday, we're co-hosting a free "trading training" webinar with our colleagues at TradingWins.com . Our goal is ...

-

The gold standard these days has been reduced to a distant memory and fantasy of hard money proponents. IF we returned to a gold standard, ...