- With the VIX near 18-month lows, here's a way you can profit from rising volatility

- And Chinese stocks are (still) not looking good - it may be time to punt on a China short

Showing posts with label leading stock market indicators. Show all posts

Showing posts with label leading stock market indicators. Show all posts

Wednesday, April 28, 2010

Two Trading Ideas: Go Long Volatility and Short China

Over on our new sister site, we've got a couple of trading ideas you may want to check out:

Monday, March 29, 2010

Why Some Key Charts Reveal the Reflation Rally May Be Tiring (Finally)

Trading From Ground Zero - We Don't Do It Enough

After going from Hero to Zero on the two S&P short positions, my March contracts expired, and I have not replaced them, instead opting to hang out in "wait and see" mode.

Contract expiration always tends to be a good exercise I find, as it forces me to ask myself "If I started over today, would I re-enter this position at current prices?" It's a question that we should ask ourselves more often - yet, we often don't, instead sitting and waiting for the market to turn our way.

Unfortunately, the market doesn't care what our positions are, it's going to go where it's going to go, whether we are long, short, or neither.

Checking in on Some Key Charts

Major indices hit new recovery highs today, with the DOW hitting it's highest mark in the last 18 months.

Trading volume remains tepid, however - as you can see from this chart of the S&P 500, this recent rally appears to lack some conviction:

Rallies have been occurring on lower volume than pullbacks.

(Chart courtesy of StockCharts.com)

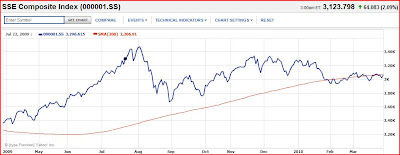

Chinese shareholders have been less exuberant of late than their American counterparts, as the Shanghai Composite Index continues to flirt with a breakdown beneath its 200 day moving average:

While US markets climb everyday, China huffs and puffs.

(Chart courtesy of Yahoo Finance).

Regular readers know that China is one of our favorite leading indicators. Is China's recovery running out of steam already?

The experts at Stratfor Global Intelligence believe that China's economy will be run on lending for at least the next year (free video clip here) - the result of which remains to be seen.

Commodities, also, continue to lag the rally in equities:

Like Chinese stocks, commodities are also well off of recovery highs.

(Chart courtesy of StockCharts.com)

Bottom Line: These non-confirmations could be ominous bearish divergences, indicating the reflation rally is on it's last legs. The rally appears tired, but is not over yet.

On the other hand, if all 3 of these charts confirm new recovery highs together, we'd have to conclude that this rally still has some room to run.

Bill Gross' Take on Portugal's Downgrade and Escaping the Sovereign Debt Trap

Ever wonder what the hell takes the rating agencies so long?

Last week, leading credit agency Fitch downgraded Portugal's debtamid "growing concerns about the government's ability to service it's borrowings."

Well - duh - increased borrowings coupled with decreasing tax revenues should raise concerns. What amazes me is that the Euro traded down today on the news - this shouldn't have been news at all, everybody saw this coming from Portugal as soon as Greece got the hiccups.

If the tax revenues were coming back, there might be hope - but revenues are not coming back anytime soon, so hope is bleak, if not non-existent. Europe is an economic basketcase with declining demographics - it's completely toast.

Bond king Bill Gross of Pimco weighed in today - in his eyes, there are three factors which could, at least theoretically, allow a country to escape the sovereign debt trap:

- It must be able to print its own widely accepted currency

- Have manageable budget deficits, and

- Find investors willing to buy their bonds (Source: Forbes)

The US, for now at least, passes all 3 tests...Greece, Portugal, and the rest of the PIGS obviously do not. Much of the rest of the world does not either.

Is sovereign debt the next domino to tumble in the global financial crisis? It sure looks like things are teetering.

Why the Federal Deficit is in Even Worse Shape Than You Think

If there was any question before that the federal deficit was completely out of control and unsustainable, the successful passing of the "free healthcare for all" plan should completely seal the deal!

As you probably recall, the out-of-control debt spiral faced by our government sparked some interesting conversation at our local Casey phyle meeting about the safety, or lack thereof, of our retirement savings.

That conversation was originally inspired by a fine piece of analysis that Bud Conrad, Casey's Chief Economist, put together for The Casey Report. They've graciously given us permission to republish Bud's piece here, so read on to learn just how bad the federal deficit is:

Current Positions - None

I don't really like anything long or short right now. I guess if you had to make a short term call, you'd go short, with the markets being as overbought as they are right now (20 of 24 days up).

But, that's a tough one to time. And with the markets now again hitting new highs, the bear market rally that began last March may not be over yet.

Tuesday, March 02, 2010

Chinese Stocks "Kiss" 200-Day SMA; More Reasons the Bubble is Bursting

OK I'll admit, it's a stretch for me to sit here in my comfy office chair in Northern California and opine about the future of the Chinese economy...especially since I've been there exactly zero times.

But the internet is a wonderful place, and it's a fun sport anyway, so with that disclosure out of the way, here's a China piece worth reading from yesterday's Daily Reckoning - China: No Shortcut to Greatness, by investment author and portfolio manager Vitaliy Katsenelson.

First, one shouldn’t believe all the economic numbers that are put out by the Chinese government. This is the government that magically managed to report 6% to 8% GDP growth in the midst of the financial crisis, when its exports were down more than 25%, tonnage of goods shipped through its railroads was down by double digits, and its electricity consumption was falling like a rock.

Second, China will do anything to grow its economy, as the alternatives will lead to political unrest. A lot of peasants moved to the cities in search of higher-paying jobs during the go-go times. Because China lacks the social safety net of the developed world, unemployed people aren’t just inconvenienced by the loss of their jobs, they starve (this explains the high savings rate in China) and hungry people don’t complain, they riot. Once you look at what’s taking place in the Chinese economy through that lens, the decisions of its leaders start making sense, or at least become understandable.

You can catch the rest of the article here.

Want a foolproof way to know how the Chinese economy is doing, from the comfort of your own living room? That's easy - just pull up a chart of the Shanghai Composite Index!

The Shanghai Composite Index recently slumped below it's 200-day SMA.

Source: Yahoo finance

We previously discussed potential weakness in Chinese stocks, and it looks like this could be bearing fruit. A decisive break below the 200-day moving average would indicate that our boy Vitaliy is on the money!

Thursday, January 21, 2010

China Flushes, The Rest of the World Begins its Financial Swirl to the Bottom

Regular readers are aware that we've been watching the Chinese market as a potential leading indicator for US equity markets for some time.

Our astute readers aside, of course, the average financial slob (or pundit, if you will) seems unaware that the Shanghai Composite topped way back in August. When I posted this chart and question about the strength of the Chinese markets just after New Year's, I was greeted with a host of comical comments on Seeking Alpha's syndication of the article (which is typical).

"Wait - isn't that a quadruple candlestick, poised for a jump to the upside?!"

To be honest - I had no clue. And still don't. But I can see that China has still not taken out its October highs.

With that, I was pleased (and not surprised) today to see that The Daily Reckoning is also on the beat of China as a leading indicator. Eric Fry writes:

Taking a slightly longer time frame into consideration, the Dow is zero for the last eight trading days…and not very far from zero for 2010. Most European markets are in negative territory for the New Year, as is the Chinese stock market.

So what gives? Do these disappointing performances point to a bad moon on the rise? Is the great big rally that ignited last March about to extinguish itself?

“Probably,” is the answer provided by Jay Shartsis, Director of Options Trading at R. F. Lafferty in New York.

Jay begins his bearish analysis by pointing out that the world-leading Chinese stock market is now leading to the downside. “The important emerging markets of China , Russia and Brazil have topped out already and have been trending lower,” he observes. “They have leading tendencies to our market, having bottomed out before ours did last March. The chart below shows that Chinese stocks (as represented by FXI, an ETF that holds Chinese stocks) [have] traced out a head and shoulder top, and is now rolling over to the downside.”

So what gives? Do these disappointing performances point to a bad moon on the rise? Is the great big rally that ignited last March about to extinguish itself?

“Probably,” is the answer provided by Jay Shartsis, Director of Options Trading at R. F. Lafferty in New York.

Jay begins his bearish analysis by pointing out that the world-leading Chinese stock market is now leading to the downside. “The important emerging markets of China , Russia and Brazil have topped out already and have been trending lower,” he observes. “They have leading tendencies to our market, having bottomed out before ours did last March. The chart below shows that Chinese stocks (as represented by FXI, an ETF that holds Chinese stocks) [have] traced out a head and shoulder top, and is now rolling over to the downside.”

With China breaking down, global markets may not be far behind.

Ed. note: If you're not a regular reader of the Daily Reckoning, I'd highly recommend you peruse their site here.

Also, regular DR and Agora readers may enjoy a review we posted a few months ago of Financial Reckoning Day Fallout.

Sunday, January 03, 2010

The Top Three Investment Themes to Watch in 2010

Happy New Year...and New Decade! Let's dive into some of the top investment themes to keep an eye on in 2010...but first, a haiku:

09 Reflation

Can it continue for long?

Dollar may foil!

1. The US Dollar: The Linchpin

The dollar, which topped out in early March roughly around the time the stock market bottomed, has been looking frisky of late. It's not above it's 200-day moving average yet, so there is some potential resistance in the short-term, but it's looking stronger by the day.

Can the re-flation trade continue to motor along if the dollar mounts a sustained rally? If the first wave of the global meltdown was any indication, then probably not. We haven't yet seen any evidence to invalidate the "all the same markets" hypothesis.

Is the dollar's recent upturn tipping off an impending markets downturn? In my opinion, this is THE theme to keep an eye on in the first quarter of 2010.

I do get a kick out of the financial media's explanations for the dollar's recent strength - leave it to them to justify the charts with "news"!

2. China: The Global Economic Savior

China has been billed as the posterchild of the global economic bounceback. Which seems appropriate, as it was also the star of the 2003-2007 credit fueled equity liftoff globally.

"China is fine," pundits say. Well, perhaps. But rather than rely on various analysis and opinions on China, I'll stick with the lazy man's approach - watching the stock market itself.

In late November, we pointed to a potential downturn in Chinese equities as some dark clouds on the financial horizon.

How's China done since then? While still perched above it's 200-day SMA, the Shanghai Composite appears to be embarking upon a third attempt to take out its early August highs.

China's rally stalls.

(Source: Yahoo Finance)

A third failure would increase the likelihood of a Chinese breakdown, and a breach of the 200-day SMA (red line above) definitely would. And if that happens, look out! I'm not sure the re-flation trade could withstand this.

3. The Banks: Still Not Lending, and Breaking Down Too

I was tempted to stop the list at #2, because we know that all the markets are still correlated...but then I pulled up this foreboding chart of the bank stocks:

Bank stocks breaking down.

(Source: Yahoo Finance)

The bank stocks are trading right around their 200-day moving average, since making their rally highs in October. So while the blue chip indices have continued to rally and make new highs, many secondary indices have failed to confirm, especially "crap" like the banks.

Summing It Up: Deflation Likely to Return (Again)

To sum it up, it looks like the re-flation trade may be running out of gas...in which case, it would be time for the dollar to rally, and for deflation to once again take the upper hand.

A couple of months ago, I reviewed my favorite inflation and deflation arguments. Since then, I don't think anything has changed. We remain at a key inflection point in the inflation/deflation battle, at least as far as 2010 is concerned.

I personally think the odds favor the scales tipping once again in the favor of deflation. Then it will get really interesting, as we'll see our heroes at the Fed again swing into action. I'm skeptical they'll be able to do much of anything useful, as I don't think they "saved" us from anything the first time around either. The markets were oversold, and set for a huge rally - and rally they did. Where they go from here will be the true litmus test.

My 2009 Trading Review: Ouch, I Suck

Usually at the end of each year, I pat myself on the back for a year well done. Well this year, unfortunately, I got rocked. So rather than dwell on it too much, I'd rather focus on learning something from my mistakes - and hopefully you can too!

In no particular order, I made a few key ones:

1. Taking position sizes that are too large. You really shouldn't risk more than 2% of your overall capital on any given trade. Because, if the trade goes against you, the most important thing is to live to see another day.

This is the top way that traders go "bust" and lose all of their capital. Something I'll try to (finally) accept in 2010!

2. Not catching market turns properly. Since 2007 or 2008 I've predominantly traded with the trend, which I believe is the right thing to do. BUT, I've gotten burned on trends switching on me. My solution? Use a more robust system for catching turns, including investor sentiment that may indicate when a move is close to bottoming, or topping.

3. Lacking a set plan for exiting a trade - whether a winner, or a loser. Stops are life savers - it's important to honor them, and again, live to see another trade!

Overall no complaints, investing and trading is often an expensive tuition, and the only way to learn it is to do it. So I'm grateful to still have a fair amount of capital intact (off of a small initial stake), and look forward to continuing to improve in 2010!

Thanks for reading!

Wednesday, October 21, 2009

Crude Oil Breaks Out, But Still a Big Fat Non-Confirmation - Where's China?

Crude oil has broken through the $80 mark once again - trading as high as $82 - before settling back in after hours trading due to "concerns about the US economic recovery." Not even joking about that one.

Crude's on the loose!

(Source: Barchart.com)

Meanwhile the Chinese equity markets - the poster child of the global economic recovery - continue to languish, unable to decide if they have the energy to break through to new highs, or merely are destined to break down once again:

China's rolling? Not so fast, my friend!

(Source: Yahoo Finance)

A few weeks ago, I pointed out these charts as major non-confirmations of the US indices recent highs. Though crude has broken through, I'm going to stick with the hypothesis as long as China languishes.

After thinking about it - crude rallied well into the summer of 2008, while the equity markets were breaking down. Crude was a lagging indicator then, so it's possible that it'll be the last to roll over this time around.

China, though, was among the first to roll over last time. And it looks like it may be doing the same once again.

If China is turning down, look out below - it could be a long way down.

Thursday, October 15, 2009

The Most Important Chart in the World...In My Humble Opinion

Is the Chinese stock market. Gold is hitting record highs, oil is breaking through to yearly highs, the DOW and S&P are hitting recent highs - but the Shanghai Composite languishes...

China: Taking a breather, or rolling over?

Source: Yahoo Finance

Do Chinese investors know something we don't?

You may recall that Chinese markets turned down before all others last time around. So, the lack of confirmation, at least thus far, from China gives me pause for now.

Does anyone know who Mr. Market is in China? Mr. Wong, perhaps? He's the boss right now...and the boss is sucking wind. Somebody grab Mr. Wong another cigarette!

Related reading: How the Chinese Government Goosed Intel's Q2 Results

Wednesday, July 15, 2009

Uh Oh - Leading Indicator Baltic Dry Index Turns Down

I have no idea what's going on with the markets right now. Just when things look most ominous, they fire up again this week big time...isn't that the way markets always work!

I have no idea what's going on with the markets right now. Just when things look most ominous, they fire up again this week big time...isn't that the way markets always work!Well for what it's worth, our friend Brian Hunt made an astute ovservation that the Baltic Dry Index has turned down once again...this classic shipping measure is often a leading indicator of economic activity. The BDI turned lower ahead of the last downturn...actually falling right through the floor...so this could be an ominous sign for the stock market, today's rally not withstanding.

Subscribe to:

Posts (Atom)

Most Popular Articles This Month

-

This Thursday, we're co-hosting a free "trading training" webinar with our colleagues at TradingWins.com . Our goal is ...

-

The gold standard these days has been reduced to a distant memory and fantasy of hard money proponents. IF we returned to a gold standard, ...

-

The race is on to acquire gold bullion while the governments of the world unite to print money as fast as they can . But unfortunately all ...