Trading From Ground Zero - We Don't Do It Enough

After going from Hero to Zero on the two S&P short positions, my March contracts expired, and I have not replaced them, instead opting to hang out in "wait and see" mode.

Contract expiration always tends to be a good exercise I find, as it forces me to ask myself "If I started over today, would I re-enter this position at current prices?" It's a question that we should ask ourselves more often - yet, we often don't, instead sitting and waiting for the market to turn our way.

Unfortunately, the market doesn't care what our positions are, it's going to go where it's going to go, whether we are long, short, or neither.

Checking in on Some Key Charts

Major indices hit new recovery highs today, with the DOW hitting it's highest mark in the last 18 months.

Trading volume remains tepid, however - as you can see from this chart of the S&P 500, this recent rally appears to lack some conviction:

Rallies have been occurring on lower volume than pullbacks.

(Chart courtesy of StockCharts.com)

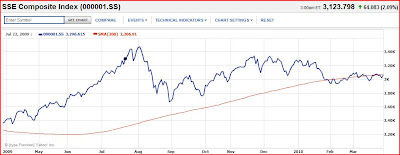

Chinese shareholders have been less exuberant of late than their American counterparts, as the Shanghai Composite Index continues to flirt with a breakdown beneath its 200 day moving average:

While US markets climb everyday, China huffs and puffs.

(Chart courtesy of Yahoo Finance).

Regular readers know that China is one of our favorite leading indicators. Is China's recovery running out of steam already?

The experts at Stratfor Global Intelligence believe that China's economy will be run on lending for at least the next year (free video clip here) - the result of which remains to be seen.

Commodities, also, continue to lag the rally in equities:

Like Chinese stocks, commodities are also well off of recovery highs.

(Chart courtesy of StockCharts.com)

Bottom Line: These non-confirmations could be ominous bearish divergences, indicating the reflation rally is on it's last legs. The rally appears tired, but is not over yet.

On the other hand, if all 3 of these charts confirm new recovery highs together, we'd have to conclude that this rally still has some room to run.

Bill Gross' Take on Portugal's Downgrade and Escaping the Sovereign Debt Trap

Ever wonder what the hell takes the rating agencies so long?

Last week, leading credit agency Fitch downgraded Portugal's debtamid "growing concerns about the government's ability to service it's borrowings."

Well - duh - increased borrowings coupled with decreasing tax revenues should raise concerns. What amazes me is that the Euro traded down today on the news - this shouldn't have been news at all, everybody saw this coming from Portugal as soon as Greece got the hiccups.

If the tax revenues were coming back, there might be hope - but revenues are not coming back anytime soon, so hope is bleak, if not non-existent. Europe is an economic basketcase with declining demographics - it's completely toast.

Bond king Bill Gross of Pimco weighed in today - in his eyes, there are three factors which could, at least theoretically, allow a country to escape the sovereign debt trap:

- It must be able to print its own widely accepted currency

- Have manageable budget deficits, and

- Find investors willing to buy their bonds (Source: Forbes)

The US, for now at least, passes all 3 tests...Greece, Portugal, and the rest of the PIGS obviously do not. Much of the rest of the world does not either.

Is sovereign debt the next domino to tumble in the global financial crisis? It sure looks like things are teetering.

Why the Federal Deficit is in Even Worse Shape Than You Think

If there was any question before that the federal deficit was completely out of control and unsustainable, the successful passing of the "free healthcare for all" plan should completely seal the deal!

As you probably recall, the out-of-control debt spiral faced by our government sparked some interesting conversation at our local Casey phyle meeting about the safety, or lack thereof, of our retirement savings.

That conversation was originally inspired by a fine piece of analysis that Bud Conrad, Casey's Chief Economist, put together for The Casey Report. They've graciously given us permission to republish Bud's piece here, so read on to learn just how bad the federal deficit is:

Current Positions - None

I don't really like anything long or short right now. I guess if you had to make a short term call, you'd go short, with the markets being as overbought as they are right now (20 of 24 days up).

But, that's a tough one to time. And with the markets now again hitting new highs, the bear market rally that began last March may not be over yet.

No comments:

Post a Comment