Goldman Sachs Charged With Fraud: Who Could Have Guessed? Part II

The firm's history suggests its vulnerability in periods of negative social mood.

By Elliott Wave International

In the November 2009 issue of Elliott Wave International's monthly Elliott Wave Financial Forecast, co-editors Steven Hochberg and Peter Kendall published a careful study of Goldman Sachs company history -- and made a sobering forecast for the firm's future: "Goldman Sachs will experience an epic fall."

In this special three-part series, we will release the entire Special Report to you free of charge.

Special Section: A Flickering Financial Star (Part II)

Despite careful stewardship, Goldman's reputation faltered as stocks fell in 1969-1970. When the Penn Central Railroad went under, it was revealed that Goldman sold off most of its own Penn Central holdings before the June 1970 bankruptcy. This was another case of shifting standards, as Goldman's customers were all institutions dealing in unregistered commercial paper. They should have known the high odds of failure, as the railroad’s stock was down almost 90% when it finally failed.

As Cycle wave IV touched its low in October 1974 (S&P;

see historic chart in Part I), a jury ruled, however, that Goldman “knew or should have known” that the railroad was in trouble. But Goldman Sachs company survived the negative judgment and grew quickly as the Cycle wave V bull market took off beginning in 1975.

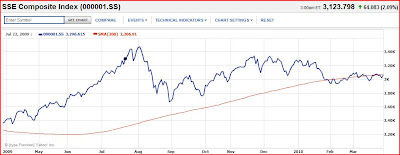

As the chart shows, its rise to 2007 was meteoric. It was in this period that Goldman “reinvented itself” as a “risk-taking principal.” By 1994, Goldman Sachs: The Culture of Success (by Lisa Endlich) says compensation policies had tilted so heavily toward risk taking that one vice president noted, “everyone decided that they were going to become a proprietary trader.” In that year, the firm suffered its first capital loss in decades as stocks sputtered, but, within a year, the Great Asset Mania was in full force and Goldman's appetite for risk took off with that of the investment public.

In 1999, the last year of a 200-year Grand-Supercycle-degree bull market, Goldman Sachs, appropriately, went public, becoming the last major Wall Street partnership to do so. As Bob Prechter's Elliott Wave Theorist said at the time, “Some of the most conspicuous cashing in has come from the brokerage sector, which has a long history of reaching for the brass ring near peaks.”

The Partnership notes that by May 2006, when a wholesale financial flight to ever-riskier financial investments was in its very latter stages, Goldman had “the largest appetite and capacity for taking risks of all sorts, with the ability to commit substantial capital.” As other firms felt the sting of an emerging risk aversion, Goldman profited by shorting the subprime housing market and putting the squeeze on its rivals. The firm earned $11.6 billion in 2007, more than Morgan Stanley, Lehman Brothers, Bear Stearns and Citigroup combined. Merrill Lynch lost $7.8 billion that year.

Another bull market initiative explains Goldman's relative strength since 2007. It dates back to the hiring of a former U.S. Treasury Secretary, as the Dow peaked in Cycle III in 1968 (see chart in Part I). This was the firm’s first foray into the upper reaches of the U.S. government. In wave V, the flow of talent went the other way and tightened the bond, as executives regularly moved from Goldman to Washington. This process was aided in part by a Goldman policy that pays out all deferred compensation to any partner who accepts a senior position in the federal government.

In May 2006, Henry Paulson, Goldman's chairman, left to become Secretary of the U.S. Treasury. Over the course of wave V and its aftermath, when government was increasingly relied upon as the buyer of last resort, these associations proved valuable to Goldman. Eventually they will weigh heavily upon the firm, but the value persists for now because the government is playing its socionomic role and clinging tenaciously to the expired trend.

Another important late-cycle development is Goldman's all-out effort to court, rather than avoid, conflicts of interest. From the 1950s through the early 1980s, Goldman leaders assiduously avoided even the perception of a conflict of interest between the firm’s positions and those of its clients. Goldman's current leader, Lloyd Blankfein, “spends a significant part of his time managing real or perceived conflicts.” Says Blankfein, “If major clients -- governments, institutional investors, corporations, and wealthy families -- believe they can trust our judgment, we can invite them to partner with us and share in the success.”

The strategy paid off big in 2008 when Henry Paulson, who was still in charge at the Treasury, helped the taxpayer step in to rescue Goldman. According to a Vanity Fair article by Andrew Ross Sorkin, Paulson had signed an ethics letter agreeing to stay out of any matter related to Goldman. In September 2008, however, Paulson received a waiver that freed him “to help Goldman Sachs,” which was faltering under the financial meltdown of a Primary-degree bear market.

It may be that the best interests of Goldman are perfectly in line with those of the nation, but in the combative atmosphere of the next downtrend in social mood, we are quite sure that voters will not see it that way. Also, the potential for self-enrichment already appears to have overwhelmed a key player. The latest headlines reveal that another former Goldman Sachs chairman, Stephen Friedman, negotiated the “secret deal” that paid Goldman Sachs $14 billion for credit-default swaps from a bankrupt AIG. He did this as chairman of the New York Fed while also serving on the board of Goldman Sachs.

This article was syndicated by Elliott Wave International. EWI is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

Ed. note - I am an EWI subscriber and affiliate - I highly recommend their work.