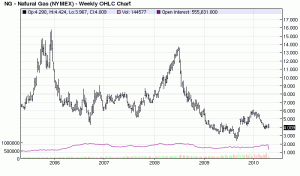

Specifically, right now, there are more bets against natural gas by large speculators than there have ever been in history.It sure has been a tough past few years for The Natty - hovering around 5-year lows!

The old rule about the large speculators goes something like this... They're "wrong at extremes, and right in between." Right now, we're at the greatest extreme, ever. Chances are, they're wrong.

The thing is, all these bets against natural gas have to be reversed... That means we must see billions of dollars worth of "buy" orders in natural gas futures, because that's the way these traders close out their trades. So the price of natural gas could rise dramatically – and possibly soar – just in the normal course of all these large speculators entering billions of dollars worth of "buy" orders to close out their bets against natural gas.

I love it.

Now think about this... Natural gas has a permanent price "floor." When it gets particularly cheap, energy companies want to substitute natural gas for what they're using – whether it's oil of some kind, or coal, or whatever.

Source: Barchart.com

Why is natural gas so hated? In short, there's too damn much of it available right now. Commodity prices are amazingly efficient at correcting supply/demand imbalances.

When Natural Gas spiked in 2006, and North America was reportedly running out of it, producers went to work, and figured out how to extract it from new places, like shale. Supply went way up, and prices collapsed - not bad for a "free" market!

If you're thinking about a speculative position here, the natural gas ETF ticker is UNG.

And if you're looking for a great supply/demand breakdown, here's a great piece of natural gas fundamental analysis by Casey Research's David Galland.

No comments:

Post a Comment