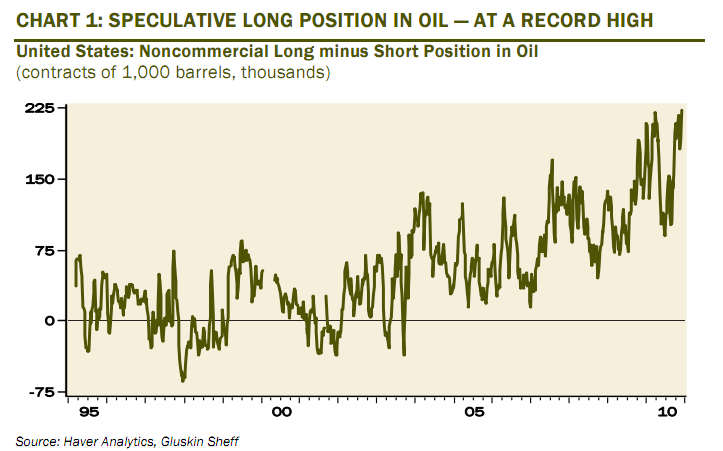

But for the shorter term, oil may be due for some degree of pullback. Speculative longs on the black goo is at an all-time high, according to our boy David Rosenberg. From today's Breakfast With Dave:

We remain long-term secular bulls on commodities, but as the charts below reveal, the net speculative position in gold, oil and copper are far too high right now for comfort. Oil is at a record high in terms of speculative net longs on the New York Mercantile Exchange.

Source: Haver Analytics, Gluskin

Surely, this is because crude is breaking out to new all-time highs, right? Ummmm, no.

While bets on crude going up are at an all-time high, the actual price of crude is still way off 2008 levels. (Source: StockCharts.com)

Peak oil crowd, beware - if you're making long bets on crude right now, you're not alone.

No comments:

Post a Comment